When to Adjust Max LTVs in QuickQual

In this guide, we'll discuss Max Loan-to-Value (LTV) figures and how they influence your QuickQuals. As we navigate through borrower scenarios, it becomes crucial to align the Max LTV settings with both program guidelines and individual borrower qualifications.

Consider a scenario where a borrower is making a 10% down payment, utilizing a single financed MI program with a specified Max LTV of 90%. It's important to enter this exact figure into the Max LTV field, ensuring it is in correspondence with the program's guidelines. Below is a step-by-step visual of this process:

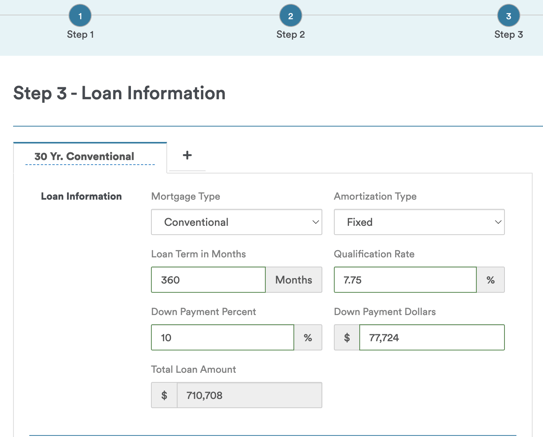

1. Navigate to Step 3 of the designated QuickQual:

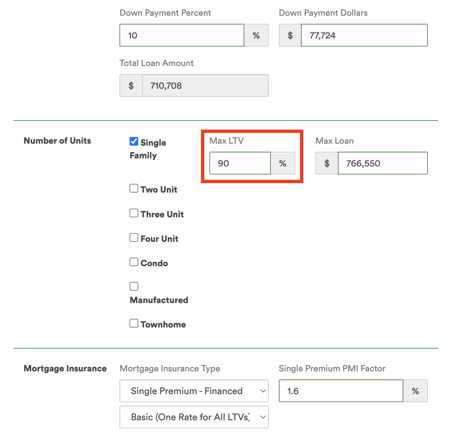

2. Enter the Max LTV Corresponding to Program Guidelines:

-

In the Max LTV field, ensure that you enter the figure corresponding to your program guidelines. If the program specifies a Max LTV of 90%, input 90% in the Max LTV field.

Be sure to save your adjustments by clicking the "Save" button at the bottom of Step 3!

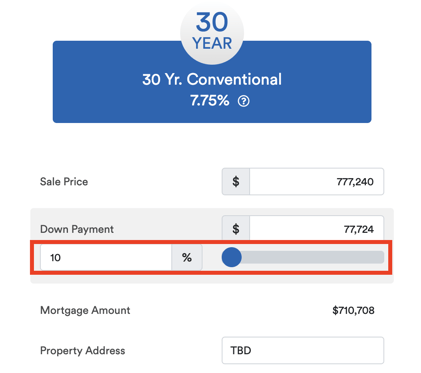

3. (Optional) Visit the calculator to review your changes:

Now, let's dive into a more nuanced example. Imagine a borrower making a standard 20% down payment for a conventional owner-occupied home. While Fannie and Freddie guidelines typically allow a borrower to go up to a 95% LTV, individual qualifications might warrant a more conservative approach. For instance, if a borrower's credit or financial reserves are less than optimal, obtaining approval with a 20% down payment might already be challenging.

Using the steps from above, you may want to consider adjusting the Max LTV downward to mitigate potential approval hurdles. A practical recommendation could be limiting the Max LTV to 80%, ensuring a more secure footing for the borrower.

This approach to Max LTV management in QuickQual empowers you to tailor scenarios to both program guidelines and the unique qualifications of individual borrowers. Should you have any questions or require further assistance, our team at LenderLogix is here to support you!