Handle Unique Loan Programs in QuickQual

This guide will walk you through the process of showcasing specialized programs, such as doctor's programs, using the existing functionality in QuickQual. Let's dive into how you can achieve this seamlessly!

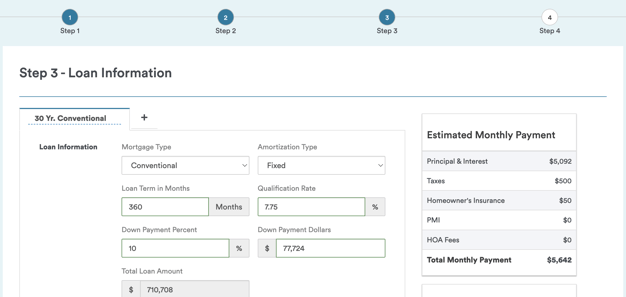

1: Loan Setup:

- Begin by entering your loan details as you normally would in QuickQual.

- Proceed to Step 3, where you'll choose your loan mortgage type.

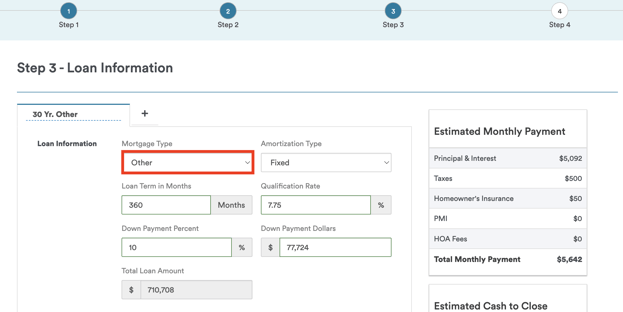

2: Mortgage Type Selection:

- Since it's a unique program, select "Other" as the mortgage type.

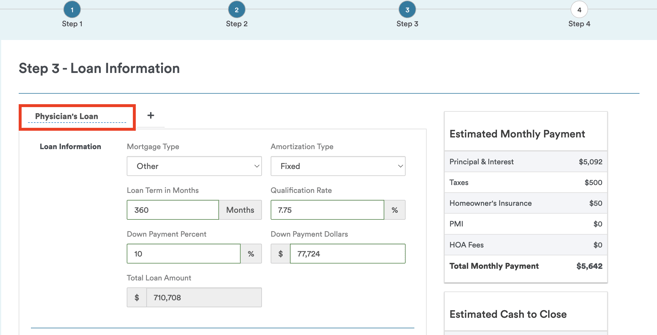

3: Program Labeling:

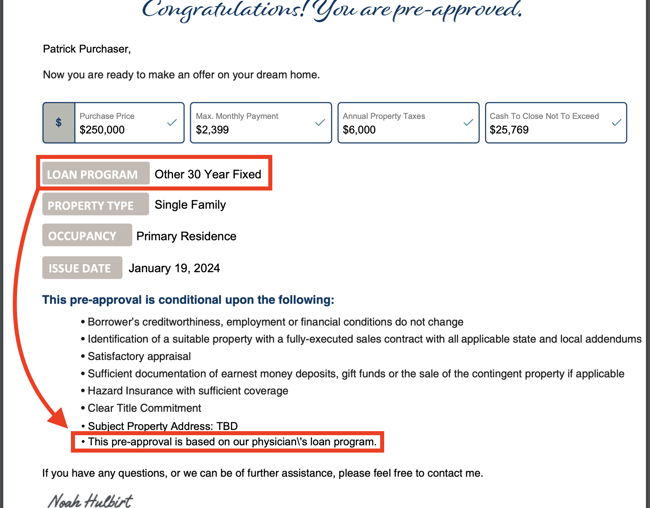

- Utilize the scenario's "Title Tab" by naming the program appropriately. For instance, let's call it a "Physician's Loan."

Borrowers and Agents using the calculator will see the program name set within the Title Tab

4: Loan Configuration:

- Continue configuring the loan by setting interest rates, down payment, LTV requirements, and any unique parameters associated with the program.

If there's a loan limit beyond conforming loan limits, be sure to include that information as well

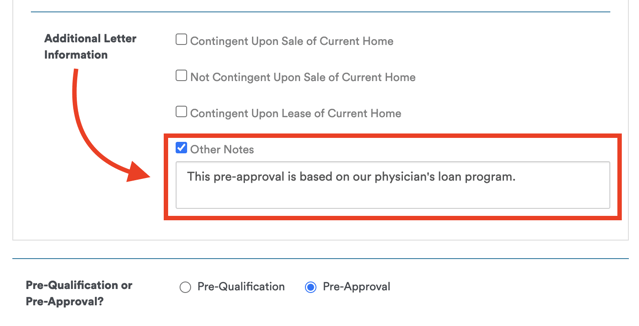

5: Additional Notes:

- In the "Additional Letter Information" section, type a note under Other Notes specifying that the pre-approval is based on the physician's program. For example, "This pre-approval is based on our physician's loan program."

6: Save and Verify:

- Save the configured loan, ensuring that all parameters and program details are accurately set.

- When issuing the letter, the loan program will be labeled as "Other," but the notes will clarify that it's based on the physician's loan program.

This method can be applied to showcase any unique loan program you have! For further assistance or questions, feel free to reach out to the LenderLogix support team.