Tiered Mortgage Insurance Rates in QuickQual

This guide will focus on how to adjust mortgage insurance rates in QuickQual to correspond with varying down payments. This allows loan officers to provide razor sharp payment estimates based on different down payment scenarios.

Step 1: Identifying Down Payment Scenarios:

- Begin by assessing the borrower's down payment preferences during the initial stages of the loan application process.

- If the borrower is considering multiple down payment options, such as 5%, 10%, or 15%, QuickQual enables you to adjust mortgage insurance rates accordingly.

Step 2: Accessing Mortgage Insurance Settings in QuickQual:

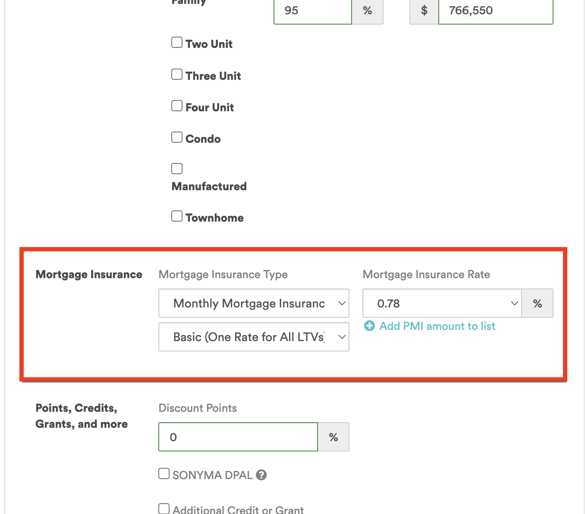

- Navigate to Step 3 of a given QuickQual

- Scroll down to the "Mortgage Insurance" section

Step 3: Change to Advanced Mortgage Insurance Settings:

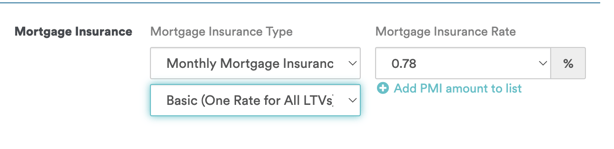

- By default, QuickQual is set to "Basic" mortgage insurance with a fixed rate, applicable regardless of the chosen down payment percentage.

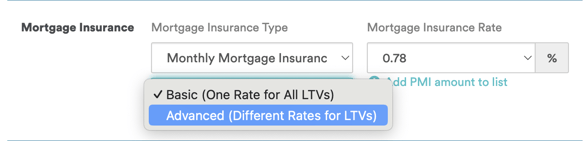

- To tailor mortgage insurance rates to specific down payment thresholds, switch from "Basic" to "Advanced" mode.

- This transition allows you to input different mortgage insurance rates for varying down payment percentages.

Prior to adjusting MI rates in QuickQual, obtain mortgage insurance rate quotes for different down payment percentages from reliable MI partner.

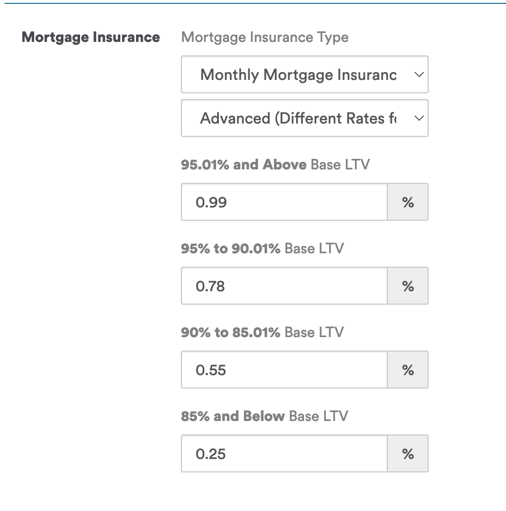

Step 4: Inputting Mortgage Insurance Rates:

- Input the obtained mortgage insurance rates for each down payment percentage into the corresponding fields in QuickQual.

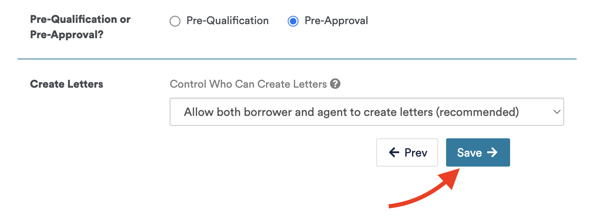

Step 7: Saving Changes and Reviewing Results:

- After inputting the mortgage insurance rates, save the changes at the bottom of Step 3 and review the updated QuickQual calculation.

- You and your borrowers will now see even more accurate payment estimates based on the chosen down payment scenarios!

By following these steps, loan officers can effectively adjust mortgage insurance rates in QuickQual to provide more precise payment quotes based on varying down payment scenarios. For further guidance or support, contact the LenderLogix team!