How to account for new maximum loan limits in QuickQual

Below we'll discuss how to manage conforming loan limits within QuickQual. As we approach the end of the year, conforming loan limits for conventional and FHA loans may increase. At LenderLogix, we aim to implement these new limits before the start of the new year. Here's how you can effectively handle conforming loan limits before the new limits are in effect:

1. Updating Loan Limits:

-

-

In the event that you are writing pre-quals or pre-approvals for borrowers who anticipate leaning on the higher limits, and these loans won't close until the new limits are in effect, you may need to account for the higher loan limit in your calculations.

-

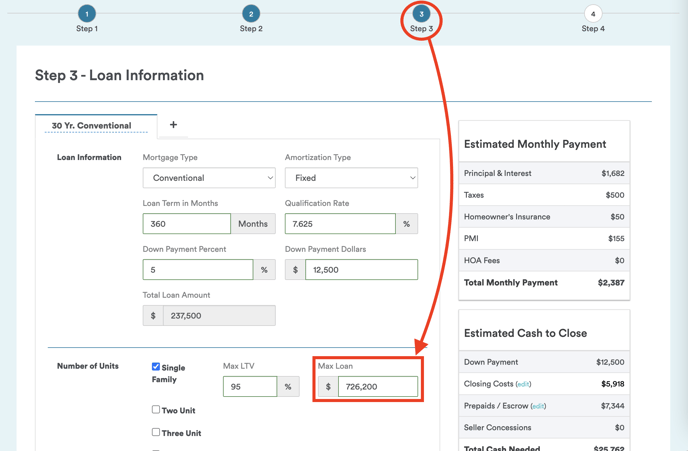

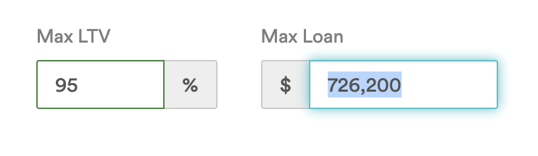

To do this, navigate to Step 3 of your QuickQual and locate the "Max Loan" field.

-

-

-

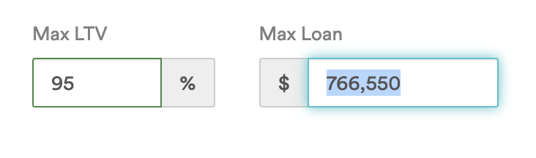

Input the increased loan limit for your borrower. This ensures that the borrower and/or agent using the calculator can explore scenarios up to the new conforming loan limit.

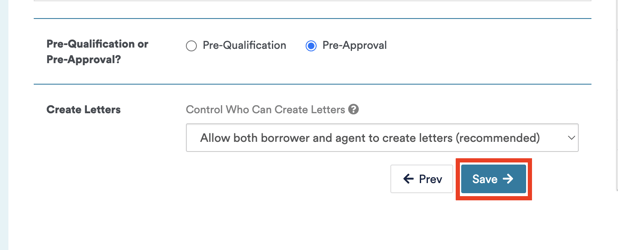

- Before the updated limit goes into effect on your borrower and/or agent's calculator, remember to scroll down to the bottom of Step 3 and click "Save." This action will update the adjusted loan limit on their calculator.

-

-

-

Conversely, if the new loan limit is already in effect, and you have a borrower closing potentially before the end of the year, you can always come back to Step 3 and reduce the loan limit back down to the prior year's limits.

-