How QuickQual Works for Mortgage Lenders

QuickQual by LenderLogix gives mortgage lenders the ability to share white-labeled, adjustable pre-qual or pre-approval letters with borrowers and referral partners. They can run payment and closing cost scenarios and update their own letters.

Instead of sending borrowers off with a static PDF, you can issue them a QuickQual and put the power of instant answers in their hands. Here's an overview of how QuickQual works for mortgage originators:

- Launch QuickQual from the Loan Origination System (LOS)

Right from within the LOS, lenders click a button to launch QuickQual. The loan information is brought over from the loan file, eliminating duplicate entry. - Set The Loan Parameters

While the greater majority of the loan information is automatically filled in, lenders will need to set the parameters (max PITI and available cash to close). - Save The Parameters & Issue the QuickQual

Once the QuickQual is created, lenders can share it with the borrower and up to two Real Estate agents via text and/or email. - Watch Activity & Reach Out as Needed

Each QuickQual has an Activity Timeline and a Login Chart. This gives lenders real-time insights into when and how often borrowers and Agents log in and generate new letters. There is also a Letter History library, so versions of the QuickQual are archived and accessible from one central location. In addition, with customizable notifications, lenders can choose to be alerted whenever a new letter is created. On average, borrowers log in 22 times per QuickQual, and Real Estate Agents generate four new letters.

Borrower and Real Estate Agents' Point-Of-View

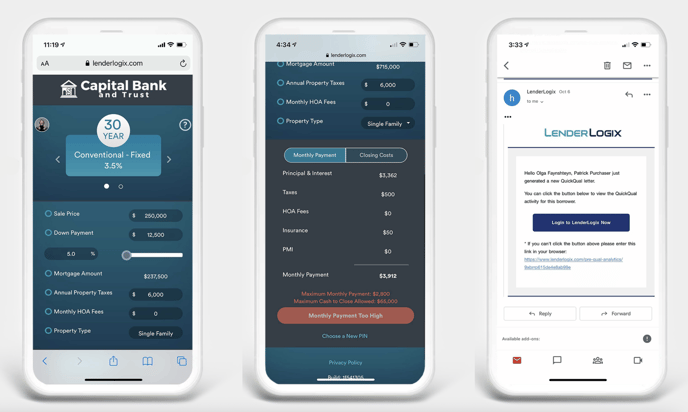

Once given access to their QuickQual, borrowers and their Realtors can run payment and closing cost scenarios on this adjustable "mortgage calculator" screen. We have to put that phrase in quotations because it's unlike any other "mortgage calculator" on the market.

Why? It's completely customized to that borrower's financials and parameters as mentioned above (max PITI and available cash to close). So homebuyers can see hyper-accurate numbers when looking at different houses.

As long as they stay within the parameters set by the lender, either party can update the letter and make an offer in a matter of seconds. If they exceed the parameters, they're unable to generate a new letter (as shown below) and instructed to reach out to their lenders.

Check out this brief video to learn more about the borrower user experience.