Adjust Interest Rates in QuickQual

Let's explore the Adjust QuickQual Rates feature within your QuickQual menu. In today's dynamic rate environment, it's crucial to ensure that interest rates used for payment calculations are up-to-date. Here's how you can effectively use this feature:

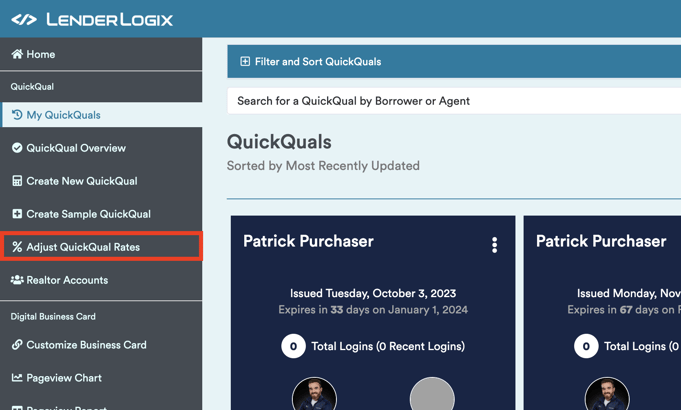

1. Access the Adjust QuickQual Rates Feature:-

- Navigate to your QuickQual menu and locate the "Adjust QuickQual Rates" feature.

- Navigate to your QuickQual menu and locate the "Adjust QuickQual Rates" feature.

-

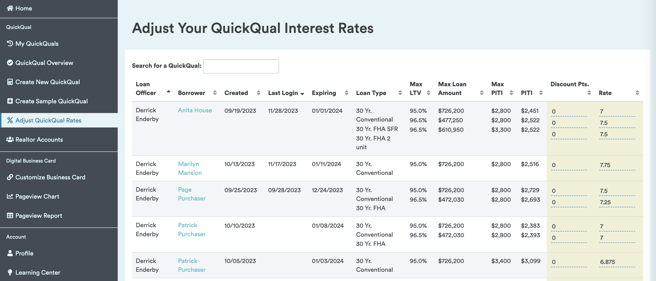

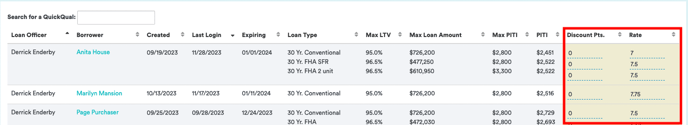

- Once accessed, you'll see a list of all your clients. If you're a manager or administrator, the list will include everyone in your branch whom you have access to. For Loan Officers, the list will display only your own clients.

- Once accessed, you'll see a list of all your clients. If you're a manager or administrator, the list will include everyone in your branch whom you have access to. For Loan Officers, the list will display only your own clients.

-

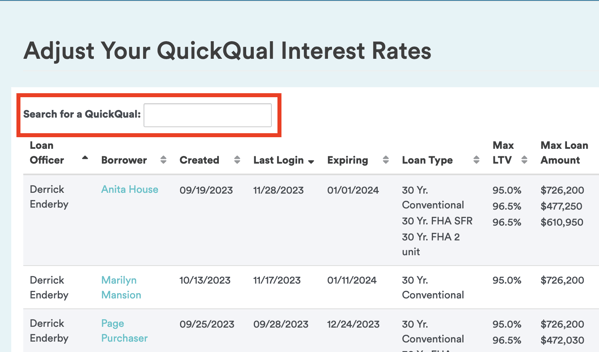

- Use the search bar to find a specific client for rate updates.

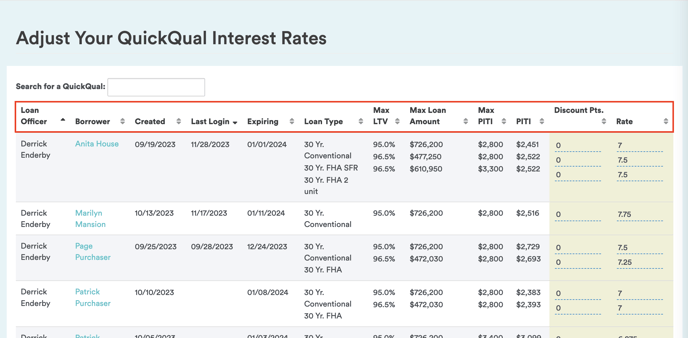

- Additionally, you can sort columns, such as loan type, to group similar clients together. Just click on which column you'd like to sort by and the results will display accordingly.

- Use the search bar to find a specific client for rate updates.

-

-

Locate the interest rates and discount points on the right-hand side.

-

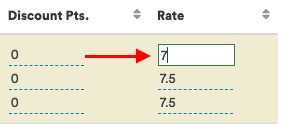

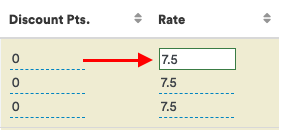

To update an interest rate, click on the corresponding field and input the new rate. For instance, changing from 7% to 7.5%.

-

-

-

When you update an interest rate, pay attention to warning indicators. If a payment previously fell below a specific limit but exceeds it after the rate change, the number will turn red.

-

-

- Use the warning indicators as cues to initiate conversations with clients. Inform them about the impact of the adjusted interest rate on their payments and loan eligibility.

By following these steps, you can proactively manage and update interest rates for your clients, ensuring accuracy and compliance in this ever-changing rate environment. If you have any questions or need assistance in understanding how the Adjust QuickQual Rates feature works, feel free to reach out to us here at LenderLogix!